An SDIRA custodian is different mainly because they have the right personnel, know-how, and ability to maintain custody in the alternative investments. Step one in opening a self-directed IRA is to locate a service provider that may be specialized in administering accounts for alternative investments.

Limited Liquidity: A lot of the alternative assets that can be held within an SDIRA, which include property, non-public fairness, or precious metals, may not be effortlessly liquidated. This may be an issue if you might want to access resources quickly.

The main SDIRA guidelines with the IRS that traders have to have to comprehend are investment constraints, disqualified individuals, and prohibited transactions. Account holders must abide by SDIRA procedures and rules so that you can preserve the tax-advantaged position of their account.

And since some SDIRAs such as self-directed regular IRAs are topic to essential minimal distributions (RMDs), you’ll ought to strategy ahead to make certain you might have plenty of liquidity to fulfill The principles set via the IRS.

Often, the expenses connected with SDIRAs is often larger and even more challenging than with an everyday IRA. It is because with the greater complexity affiliated with administering the account.

Bigger investment alternatives implies you are able to diversify your portfolio further than stocks, bonds, and mutual money and hedge your portfolio in opposition to current market fluctuations and volatility.

Real estate property is one of the most popular possibilities amongst SDIRA holders. That’s since you are able to invest in any kind of real estate property which has a self-directed IRA.

Making essentially the most of tax-advantaged accounts means that you can continue to keep far more of the money that you simply commit and earn. Determined by whether you decide on a conventional self-directed IRA or maybe a self-directed Roth IRA, you have got the potential for tax-no cost or tax-deferred progress, provided sure ailments are achieved.

Complexity and Obligation: Having an SDIRA, you might have additional Management above your investments, but In addition, you bear far more duty.

Be in command of how you expand your retirement portfolio by utilizing your specialised expertise and passions to speculate in assets visit this site right here that healthy with the values. Bought knowledge in real estate property or non-public equity? Utilize it to aid your retirement planning.

Place simply, should you’re looking official site for a tax successful way to build a portfolio that’s additional tailored towards your pursuits and abilities, an SDIRA may be the answer.

Including dollars directly to your account. Keep in mind that contributions are topic to yearly IRA contribution limits set by the IRS.

Being an investor, even so, your options are usually not limited to shares and bonds if you end up picking to self-immediate your retirement accounts. That’s why an SDIRA can completely transform your portfolio.

Variety of Investment Options: Ensure the service provider makes it possible for the types of alternative investments you’re keen on, which include real estate property, precious metals, or Portfolio diversification specialists non-public fairness.

Certainly, housing is among our purchasers’ most favored investments, occasionally termed a real-estate IRA. Customers have the choice to invest in all the things from rental Houses, commercial real estate property, undeveloped land, mortgage loan notes plus much more.

Ahead of opening an SDIRA, it’s crucial to weigh the probable positives and negatives based on your precise fiscal objectives and hazard tolerance.

As opposed to shares and bonds, alternative assets will often be more challenging to market or can come with strict contracts and schedules.

Have the freedom to invest in Nearly any type of asset with a danger profile that fits your investment technique; which include assets that have the possible for a better rate of return.

Relocating funds from a single sort of account to another form of account, for instance relocating resources from a 401(k) to a traditional IRA.

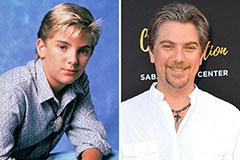

Ross Bagley Then & Now!

Ross Bagley Then & Now! Jeremy Miller Then & Now!

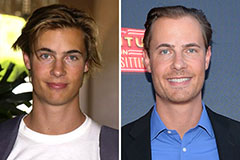

Jeremy Miller Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!